How Satisfied Are You With Your Financial Goals?

Hello and welcome to Radiant Wealth Planning, a virtual financial planning and investment management firm exclusively for women. I’m Randa Hoffman, owner, and financial planner, and I’m located in sunny Newport Beach, California.

Today’s blog is about figuring out how to identify those mysterious financial goals we always talk about, believe it or not, they could be hard to define. A lot of financial planners know that when they ask a client “what are your financial goals?” that it’s a crappy question, but they don’t know how to help their clients dig deep and think through what is important to them and what a fulfilled life looks like. Not only is this question so vague but clients don’t like being asked it for so many reasons. It could be that they don’t know what life will look like in 20 years and don’t know what to plan for, and so the default answer “I want to retire at 65” is given. As some people are wrecking your brain to come up with an answer, others know that when they meet with an advisor, they’ll be asked this question and that causes stress, so they would prefer to not start the process.

I’m going to share how clients and I do it, and I hope that you do this for yourself as well. If you’re in a relationship do this exercise with your partner because it’s very insightful and will bring awareness if the two of you are on the same page for what you want from life. This is an important conversation to be had, and a good financial planner can help guide the conversation, but it truly needs to occur between the two of you honestly and safely.

When a woman signs up for a Discovery meeting, she gets an email that helps her to start thinking about this before we meet. In the email, there are 3 questions, and I ask that answering them isn’t done in one session.

The objective isn’t completing the work, it’s taking the time and putting thought into it. Each question should be given at least 3 answers or mini statements. Why do I ask that each question have at least 3 answers? I want each answer to be asked “why is that important?” and write that answer down, and then do it again by asking “why is that new answer important?” until you get to the heart of the “why”. You’ll know you’re there when the answer brings up emotion for why you want to do that thing you want to do.

The three questions are:

What goals do you have now?

What are the three most important things you want to accomplish in the next 5 to 10 years?

What are your worries for the future?

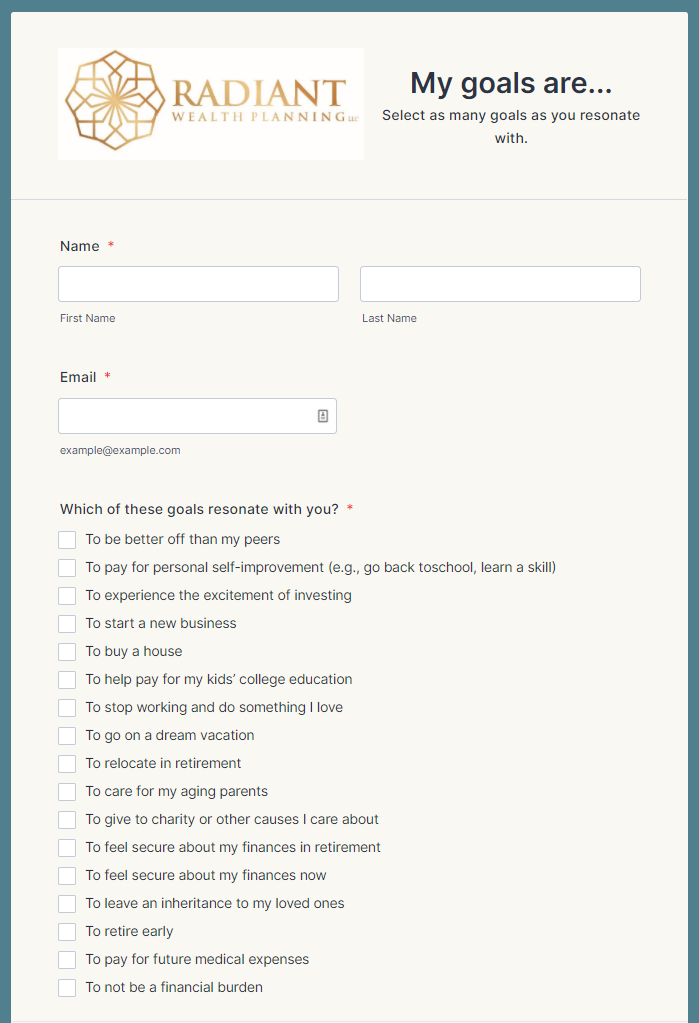

This might also feel like a little stretch and a lot of work so I also provide this checklist that has some goal ideas that might resonate.

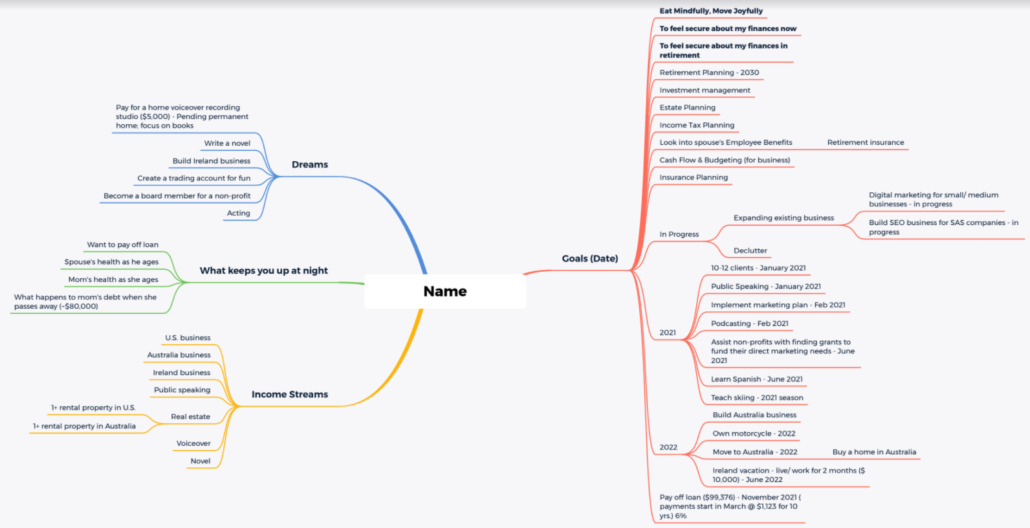

During the Discovery meeting is where all these ideas come together. We use something called a mind map, it’s a fun visual to see everything she has going on. We split out goals that have dates from dreams that don’t have dates tied to them. And if you see, there are things in here that you might think you probably won’t share with your financial planner, like learn Spanish, but I want to know what’s important to you so that we can celebrate all your wins.

I’ve provided a link below that you can access to download a two-page list of goals. It’s a list of questions in nine different categories of life to being the thought process and ideas flowing. The nine sections are retirement goals, family goals, self-development and professional goals, asset and debt goals, and on the other side, there are lifestyle goals, tax planning goals, health care goals, estate planning and wealth transfer goals, and miscellaneous goals. Take some time filling it out and adding to it. And like I mentioned earlier if you’re in a relationship do this together with your partner.

I hope you’ve enjoyed this blog and if you want to read more from me, be sure to sign up for our monthly newsletter at RadiantWealthPlanning.com, and like us on any mediums you find yourself on, whether it be YouTube, Facebook, Instagram, or LinkedIn.

Click here to download the document.

Welcome to our blog where we share tips and advice on all topics that help women meet their financial goals.

Randa Hoffman is the owner and financial planner at Radiant Wealth Planning, a fee-only financial planning and investment management firm exclusively for women. She helps ease the uncertainty around retirement, tax planning, and transitioning wealth so that women can live a life they’ve always dreamt of. She holds an MBA and EA and lives in Newport Beach, CA.

Randa Hoffman is the owner and financial planner at Radiant Wealth Planning, a fee-only financial planning and investment management firm exclusively for women. She helps ease the uncertainty around retirement, tax planning, and transitioning wealth so that women can live a life they’ve always dreamt of. She holds an MBA and EA and lives in Newport Beach, CA.